Coronavirus Business Interruption Loan Scheme (CBILS)

UPDATED 8 July 2020

More than 53,500 Coronavirus Business Interruption Loans have now been approved with almost £11.5 billion lent.

This is from over 100 participating lenders in the Scheme. They include:

- high-street banks

- challenger banks

- asset-based lenders

- smaller specialist local lenders

A lender can provide up to £5 million in the form of:

- term loans

- overdrafts

- invoice finance

- asset finance

Following the launch of the Coronavirus Bounce Back Loans Scheme, the Coronavirus Business Interruption Loan Scheme is now available for loans of £50,001 and above.

If you’ve already received a loan of up to £50,000 under CBILS and would like to transfer it into the Bounce Back Loan scheme, you can arrange this with your lender until 4 November 2020.

Main Scheme Details

In the Budget 2020 on Wednesday 11 March, the Chancellor announced a “Coronavirus Business Interruption Loan Scheme” (CBILS), and that it would become available “over the coming weeks”.

This has been brought forward, and the new scheme is available from 23 March 2020 and will initially run for 6 months.

It will be provided by the British Business Bank through participating providers and will offer more attractive terms for both businesses applying for new facilities and lenders, with the aim of supporting the continued provision of finance to UK businesses during the Covid-19 outbreak.

Eligibility

- This measure is targeted towards UK based SMEs with a turnover of no more than £45 million per annum

- Generate more than 50 percent of turnover from trading activity

- Have a borrowing proposal which, were it not for the COVID-19 pandemic, would be considered viable by the lender, and for which the lender believes the provision of finance will enable the business to trade out of any short-to-medium term difficulty.

- All business owners looking to borrow less than £250,000 will no longer have to offer up personal guarantees.

- The requirement for businesses to have first tried to get a normal commercial loan elsewhere has been dropped.

Finance terms are from three months up to six years for term loans and asset finance and up to three years for revolving facilities and invoice finance.

However, it has been confirmed that the delivery of the Scheme, including all lending decisions, is fully delegated to the lending partners. It is for each individual lender to decide whether EFG is appropriate and confirm whether a business is eligible. While the British Business Bank provides a guarantee to the lender, they have no role in the decision-making process and are not party to the agreement between the borrowing business and the lender.

Are any businesses excluded from the scheme?

Businesses from any sector can apply, except the following:

- Banks and building societies

- Insurers and reinsurers (but not insurance brokers)

- Public-sector organisations, including state-funded primary and secondary schools

- Employer, professional, religious or political membership organisations

- Trade unions

Please refer to Appendix 1 for other eligibility restrictions.

Scheme

The scheme provides the lender with a government-backed guarantee against the outstanding facility balance, potentially enabling a ‘no’ credit decision from a lender to become a ‘yes’. Note – the borrower always remains 100% liable for the debt.

The maximum value of a facility provided under the scheme will be £5 million (the original Budget announcement suggested a maximum value of £1.2 million).

The Government will also cover the first 12 months of interest payments, so businesses will benefit from lower initial repayments. The business remains liable for repayments of the capital.

As well as loans, there are many other types of finance supported by the programme, depending on the provider.

Lenders

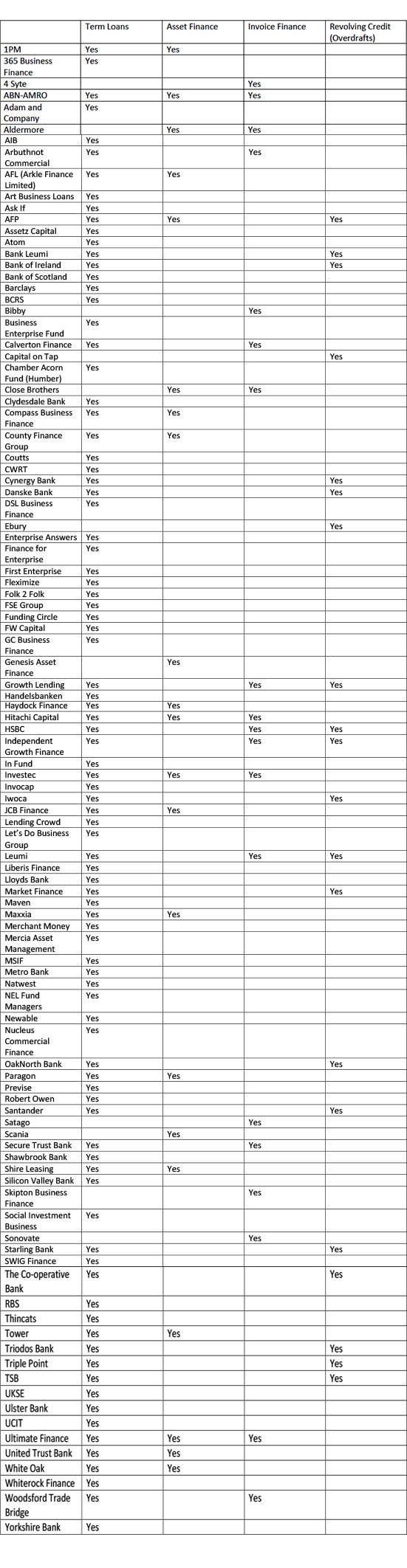

Details of the lenders and what type of finance they provide is shown in the following table: