Coronavirus Job Retention Scheme

UPDATED 8 July 2020

- The Scheme has been extended to the end of October 2020

- Furloughed employees will continue to receive 80% of their current salary, up to £2,500 a month

- From 1 July 2020, businesses will be given the flexibility to bring furloughed employees back part time.

- From August 2020, the level of government grant provided through the job retention scheme will be slowly tapered to reflect that people will be returning to work. That means that for June and July the government will continue to pay 80% of people’s salaries. In the following months, businesses will be asked to contribute a modest share, but crucially individuals will continue to receive that 80% of salary covering the time they are unable to work.

- This means that the current scheme will effectively close to new entrants on 30 June, with the last three-week furloughs before that point commencing on 10 June.

As at close of business on 8 July, the Scheme had administered the following:

- 9.4 million jobs furloughed

- 1 million employers furloughing

- Total value of claims is £27.4 billion

Scheme Details from 1 July

- To enable the introduction of part time furloughing, and support those already furloughed back to work, claims from July onwards will be restricted to employers currently using the scheme and previously furloughed employees.

- From 1 July, employers will be able to agree any working arrangements with previously furloughed employees.

- When claiming the CJRS grant for furloughed hours; employers will need to report and claim for a minimum period of a week, for grants to be calculated accurately across working patterns.

- The following will apply for the period people are furloughed:

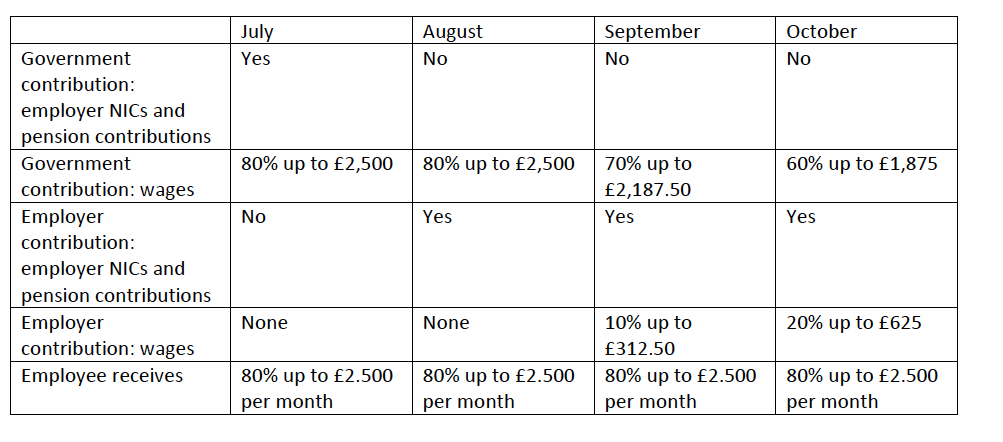

- June and July: The government will pay 80% of wages up to a cap of £2,500 as well as employer National Insurance and pension contributions. Employers are not required to pay anything.

- August: The government will pay 80% of wages up to a cap of £2,500. Employers will pay employer National Insurance and pension contributions – for the average claim, this represents 5% of the gross employment costs the employer would have incurred had the employee not been furloughed.

- September: The government will pay 70% of wages up to a cap of £2,187.50. Employers will pay employer National Insurance and pension contributions and 10% of wages to make up 80% total up to a cap of £2,500. For the average claim, this represents 14% of the gross employment costs the employer would have incurred had the employee not been furloughed.

- October: The government will pay 60% of wages up to a cap of £1,875. Employers will pay employer National Insurance and pension contributions and 20% of wages to make up 80% total up to a cap of £2,500. For the average claim, this represents 23% of the gross employment costs the employer would have incurred had the employee not been furloughed.

Flexible furloughing

- When claiming the CJRS grant for furloughed hours; employers will need to report and claim for a minimum period of a week.

- This is a minimum period and those making claims for longer periods such as those on monthly or two weekly cycles will be able to do so.

- To be eligible for the grant, employers must agree with their employee any new flexible furloughing arrangement and confirm that agreement in writing.

- Employers can claim the grant for the hours their employees are not working calculated by reference to their usual hours worked in a claim period. Further details will be included in future guidance.

- Employers will need to report hours worked and the usual hours an employee would be expected to work in a claim period.

- For worked hours, employees will be paid by their employer subject to their employment contract and employers will be responsible for paying the tax and NICs due on those amounts.

Closure to new entrants from July

- The scheme will close to new entrants from 30 June. From this point onwards, employers will only be able to furlough employees that they have furloughed for a full three-week period prior to 30 June.

- This means that the final date by which an employer can furlough an employee for the first time will be the 10 June, in order for the current three-week furlough period to be completed by 30 June. Employers will have until 31st July to make any claims in respect of the period to 30 June.

- From 1 July the scheme will only be available to employers that have previously used the scheme in respect of employees they have previously furloughed.

- From 1 July, claim periods will no longer be able to overlap months, employers who previously submitted claims with periods that overlapped calendar months will no longer be able to do this going forward. This is necessary to reflect the forthcoming changes to the scheme.

- The number of employees an employer can claim for in any claim period cannot exceed the maximum number they have claimed for under any previous claim under the current CJRS.

- Employers can continue to make claims in anticipation of an imminent payroll run, at the point payroll is run or after payroll has been run.

- Employers will be able to make their first claim under the new scheme from 1 July.

Government contribution, required employer contribution and amount employee receives where the employee is furloughed 100% of the time

Original Scheme Details

Please note the detailed criteria shown below for the first scheme will apply equally to the scheme from 1 July.

On Friday 20 March, the Chancellor announced an unprecedented economic intervention with the Government stepping in and helping to pay people’s wages. This has been modified many times since the original announcement and below details the most up to date position.

What it is and what will it cover?

The Coronavirus Job Retention Scheme will be a government grant – to reimburse employers for 80% of furloughed workers wage costs, to a cap of £2,500 per month.

Further the scheme will be:

- Backdated to March 1st

- Open until the end of October 2020. Initially, the Scheme was launched for three months, which was extended to four months.

- However, it is expected that from August, employers will be asked to pay a percentage towards the salaries of their furloughed staff.

In addition, employers can also claim the associated employers’ national insurance contributions (NIC) on this amount and the minimum automatic enrolment employer pension contributions on that wage.

Please note employers can top up wages to beyond the scheme maximum thresholds if they wish, but there is no requirement to do this.

Past Overtime, Fees, Commission, Bonuses and non-cash payments

You can claim for any regular payments you are obliged to pay your employees. This includes wages, past overtime, fees and compulsory commission payments. However, discretionary bonus (including tips) and commission payments and non-cash payments should be excluded.

Benefits in Kind and Salary Sacrifice Schemes

The reference salary should not include the cost of non-monetary benefits provided to employees, including taxable Benefits in Kind. Similarly, benefits provided through salary sacrifice schemes (including pension contributions) that reduce an employee’s taxable pay should also not be included in the reference salary.

Where the employer provides benefits to furloughed employees, this should be in addition to the wages that must be paid under the terms of the Job Retention Scheme.

Normally, an employee cannot switch freely out of a salary sacrifice scheme unless there is a life event. HMRC agrees that COVID-19 counts as a life event that could warrant changes to salary sacrifice arrangements, if the relevant employment contract is updated accordingly.

Who is eligible for the scheme?

All UK businesses are eligible (or in the Chancellor’s words “Any employer in the country – small or large, charitable or non-profit – will be eligible for the scheme.”)

What employees are eligible?

Furloughed employees must have been on the PAYE payroll on 19 March 2020 (previously 28 February 2020). However, these employees not only need to be on the payroll by 19 March but also must have been notified to HMRC on an RTI (Real Time Information) submission by that dat. They can be on any type of contract, including:

- full-time employees;

- part-time employees;

- employees on agency contracts; and

- employees on flexible or zero-hour contracts.

Employees whose pay varies

If the employee’s salary varies (e.g. staff on zero-hour contracts) and they have been employed for a full twelve months prior to the claim, employers claim for the higher of either:

- the same month’s earning from the previous year; and

- average monthly earnings from the 2019-20 tax year.

Employees who have worked less than a year

If the employee has been employed for less than a year, the employer can claim for an average of their monthly earnings since they started work. If the employee only started in February 2020, use a pro-rata for their earnings so far to claim.

If an employee is between jobs, what support is available?

The scheme also covers employees who left their job or were made redundant since 19 March 2020, if they are rehired by their employer.

New employees hired after 19 March 2020 cannot be furloughed or claimed for in accordance with this scheme.

Scheme administration

Coronavirus Job Retention Scheme will be administered by HMRC.

Employers will need to:

- Designate affected employees as ‘furloughed workers’ (see further below)

- Submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal (HMRC will set out further details on the information required).

As noted above the grant is a reimbursement to the employer therefore the employer will make the wage/ salary payment to the furloughed worker and then be reimbursed by HMRC.

When will the scheme be live?

The dedicated HMRC portal for employers to make claims went live at 08.00 on Monday 20 April 2020 and 2 million employers should have received an email with details on how to make a claim.

This included links to updated guidance on how to calculate the claim and a simple step-by-step guide.

There will also be a calculator available for employers to check their calculations online before they make your claim.

Employers have been advised to have all of their information and calculations ready before they begin your application. Employers should retain all records and calculations in case HMRC need to contact them.

The information required is:

- ePAYE reference number

- the number of employees being furloughed

- the claim period (start and end date)

- amount claimed (per the minimum length of furloughing of 3 consecutive weeks)

- bank account number and sort code

- contact name

- phone number

A copy of the screenshots is included in Appendix 1.

It was previously reported that .xls, .xlsx, .cvs and .ods files can be used for uploading employees but only for 100 or more employees. For less than 100 employees, we were expecting individual entries would be needed.

HMRC have said that they will be paying grants within 6 business days.

What is a furloughed worker?

We understand that furloughed workers are “workforce who remain on payroll but are temporarily not working during the coronavirus outbreak”.

To be eligible for the subsidy, when on furlough, an employee can not undertake work for or on behalf of the organisation. This includes providing services or generating revenue.

It is noted that employers will need to notify employees of this change in employment status to furloughed, but that changing the status of employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation.

Can furloughed workers be rotated?

It appears as though they can. Some employers have work for some staff, but not enough work for all. It appears that employees can be placed on furlough more than once.

This suggests that employers can rotate employees on furlough, so long as each employee spends a minimum of three weeks on furlough. This would mean, for example, that an employer can select an initial group of employees for furlough while a second group remain at work. The first group could then come back to work while the second group take their turn on furlough.

How long can workers be furloughed?

The minimum length of furloughing is three weeks. An employee can however be furloughed multiple times, subject to the minimum time period of three weeks, as often as the employer and employee agree.

The scheme will be open for an initial period of four months (1 March to 30 June 2020) but it might be extended.

This has already been extended by 1 month.

Employers are likely to want to reserve the right to call employees back from furlough if trading conditions improve.

Can a Financial Adviser be furloughed?

The following is our current understanding, but we are expecting further guidance from the FCA shortly.

It is possible to furlough an adviser, but we would only expect to see this happen where the work undertaken, including client reviews, new business or any ad hoc client queries that come in can be picked up by another adviser in the business.

This is more viable where the adviser deals with transactional business, such as mortgage advice, or for trainees, where the work is already overseen by a more senior adviser who might already have a working relationship with the clients. It should be uncommon in small investment advice firms.

A furloughed adviser cannot continue to work during this period so some thought should be given to re-routing calls and emails.

Can a furloughed worker do volunteer work or training

A furloughed employee can take part in volunteer work or training, as long as it does not provide services to or generate revenue for, or on behalf of the organisation.

However, if workers are required to, for example, complete online training courses whilst they are furloughed, then they must be paid at least the NLW/NMW for the time spent training, even if this is more than the 80% of their wage that will be subsidised.

Can a furloughed worker continue with their Continued Professional Development (CPD)

This is relevant for Financial Advisers.

Our understanding is that a furloughed worker should keep up to date with their CPD. This is based on the understanding that, even whilst furloughed, they are authorised to give advice.

If a furloughed works is selected for a CPD audit, we would expect the relevant trade body to be as flexible as possible during the current time.

Can an apprentice be furloughed

Apprentices can be furloughed in the same way as other employees and they can continue to train whilst furloughed.

However, you must pay your Apprentices at least the Apprenticeship Minimum Wage, National Living Wage or National Minimum Wage (AMW/NLW/NMW) as appropriate for all the time they spend training. This means you must cover any shortfall between the amount you can claim for their wages through this scheme and their appropriate minimum wage.

Can a personal employee (e.g. child’s nanny) be furloughed

Individuals can furlough employees such as nannies provided they pay them through PAYE and they were on their payroll on, or before, 19 March 2020.

Can employees who are shielding or have caring responsibilities be furloughed

You can claim for furloughed employees who are shielding in line with public health guidance (or need to stay home with someone who is shielding) if they are unable to work from home and you would otherwise have to make them redundant.

Similarly, employees who are unable to work because they have caring responsibilities resulting from coronavirus can be furloughed. For example, employees that need to look after children can be furloughed.

Can company directors be furloughed?

Company directors that receive salaries through PAYE can be furloughed.

Company directors owe duties to their company which are set out in the Companies Act 2006. Where a company (acting through its board of directors) considers that it is in compliance with the statutory duties of one or more of its individual salaried directors, the board can decide that such directors should be furloughed. Where one or more individual directors’ furlough is so decided by the board, this should be formally adopted as a decision of the company, noted in the company records and communicated in writing to the director(s) concerned.

The same rules apply about not being able to provide services to or generate revenue for, or on behalf of the company. This could include tweeting from an official account or on behalf of the company. Also, they cannot make phone calls or discuss the firm or its business.

Where furloughed directors need to carry out particular duties to fulfill the statutory obligations they owe to their company (e.g. relating to filing documents to Companies House at the correct time), they may do so provided they do no more than would reasonably be judged necessary for that purpose.

This also applies to salaried individuals who are directors of their own personal service company (PSC).

Can furloughed employees take other jobs?

People on furlough and being paid 80% of their regular pay by their employer to do nothing under the Coronavirus Job Retention Scheme can take other work along as their employment contract does not forbid it.

How do you furlough your workers?

Two example furlough letters are included in Appendices 2 and 3.

Money Saving Expert – guide for employees and small firms

For some employees and employers without HR departments, furloughing can seem complex. Money Saving Expert have produced a quick info sheet which is intended to make it simple, allowing employees and employers to help each other through it. This is included in Appendix 4.

How do you end furlough for employees?

You should regularly review furlough agreements to decide when to bring furloughed staff back to work.

It can help employers to consider:

- which job roles and skills are needed in the workplace

- if all furloughed staff are needed back at the same time

- if any staff might be kept on furlough because they’re temporarily unable to work, for example, if they’re caring for someone or are shielding

To end furlough, you should give staff notice in writing.

There’s no minimum notice period for furlough, but you should:

- talk to staff about any plans to end furlough as early as possible

- encourage staff to raise any concerns or problems about returning to work

An example letter to end furlough is included in Appendix 5.

What you’ll need to make a claim

Employers should discuss with their staff and make any changes to the employment contract by agreement.

Employers may need to seek legal advice on the process. If sufficient numbers of staff are involved, it may be necessary to engage collective consultation processes to procure agreement to changes to terms of employment.

To claim, you will need:

- your ePAYE reference number

- the number of employees being furloughed

- the claim period (start and end date)

- amount claimed (per the minimum length of furloughing of 3 consecutive weeks)

- your bank account number and sort code

- your contact name

- your phone number

You will need to calculate the amount you are claiming. HMRC will retain the right to retrospectively audit all aspects of your claim.