Help to Buy – Providing support to homebuyers

The government-backed Help to Buy scheme comprises three elements:

- an ‘equity loan’ – for brand new homes in England & Wales

- a ‘mortgage guarantee’ – for new-build or existing homes anywhere in the UK

- NEW: a ‘Help to Buy ISA’ – to help first-time buyers save for a deposit

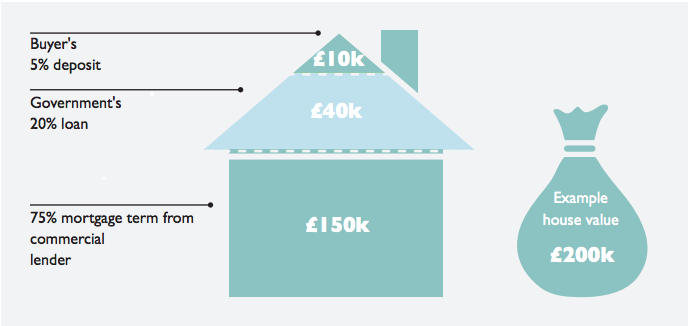

Help to Buy equity loans

With a Help to Buy equity loan you only need a 5% deposit and a 75% mortgage – the government will lend you up to 20% to fill the gap. Help to Buy equity loans are open to both first-time buyers and homemovers. They can be used towards new-build homes worth up to £600,000.

The scheme is not available for those wishing to purchase a second home or a Buy to Let property. The equity loan must be repaid after 25 years – or earlier if you sell your home.

You must repay the same percentage of the proceeds of the sale as the initial equity loan (ie. if you received an equity loan for 20% of the purchase price of your home, you must repay 20% of the proceeds of the sale). The equity loan is interest free for the first five years. After that, you will pay a fee of 1.75%, rising annually by the increase (if any) in the Retail Price Index (RPI) plus 1%.

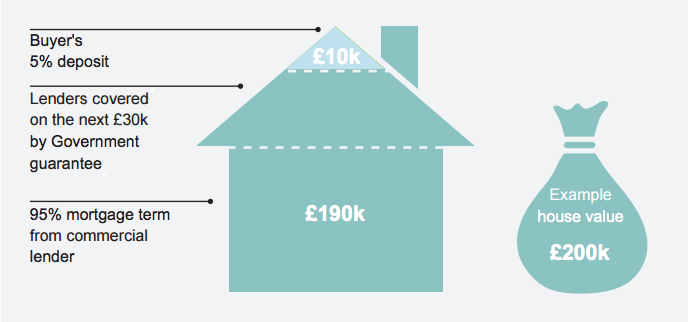

Help to Buy mortgage guarantee

The Help to Buy mortgage guarantee scheme works by offering lenders the option to purchase a guarantee on mortgages where a borrower has a deposit of between 5% and 20%. Help to Buy mortgage guarantees are open to both first-time buyers and homemovers. They can be used towards new-build homes or existing properties worth up to £600,000.

The guarantee protects the lender rather than the borrower against losses. Borrowers remain fully responsible for their mortgage payments and any shortfall in the normal way.

Help to Buy ISA

The new tax-free Help to Buy ISA will be available to first-time buyers from 1 December 2015. Under the new scheme you can save up to £200 every month and the government will then add a 25% top-up.

If you save the maximum every month, the government will add in £50 up to a maximum of £3,000. You will also be able to save an additional £1,000 when you first open the ISA. This means you can save £1,200 in the first month and it will be topped up by £300.

Accounts are limited to one per person, but if you are saving as a couple you could qualify for a £6,000 bonus. This could make all the difference if you are looking to buy your first home together.

Tax concessions are not guaranteed and may change in the future.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Content reproduced by permission of Openwork Ltd.