How Much Can You Pay Into Your Pension This Year?

From 6 April 2016, the amount of tax relief people earning more than £150,000 can receive on their pension contributions will be limited.

Between now and then, however, there’s a window of opportunity that means you can pay more into your pension than you might realise.

You could invest up to £40,000 in your pension

During his 8 July Budget announcement, the Chancellor confirmed that the Pension Input Period would be aligned to the tax year. This means you could put another £40,000 into your pension between now and 5 April 2016 without incurring a tax charge.

A window of opportunity

A window of opportunity

The £40,000 annual allowance usually applies to pension contributions made each tax year, including those made by you and your employer and benefits built up in a final salary scheme.

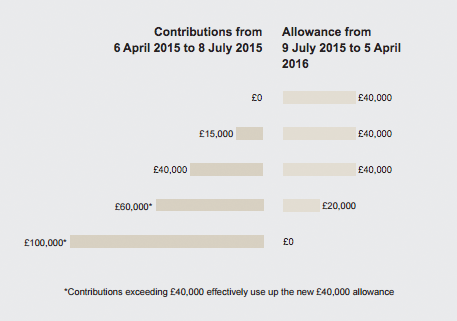

A new £40,000 allowance has effectively been introduced for contributions made from 9 July 2015 to 5 April 2016.

Note: if you invested more than £40,000 between 6 April 2015 and 8 July 2015, your new allowance may be reduced by this amount.

Definitions

Pension Input Period – a period of time over which the pension input amount under a scheme is measured, in order that a check can be made to see if the Annual Allowance for the related tax year has been exceeded.

Annual Allowance – the maximum that you, or someone else (eg. your employer), can contribute to all the pensions you hold in a year, without incurring a tax charge.

The annual allowance is £80,000 for the 2015/16 tax year, including benefits being built up in a final salary pension.

If you have accessed your pension since 6 April 2015, or are in flexible drawdown, a reduced contribution limit may apply.

Content reproduced by permission of Openwork Ltd.

Contains public sector information licensed under the Open Government Licence v3.0.