Investing after a market fall

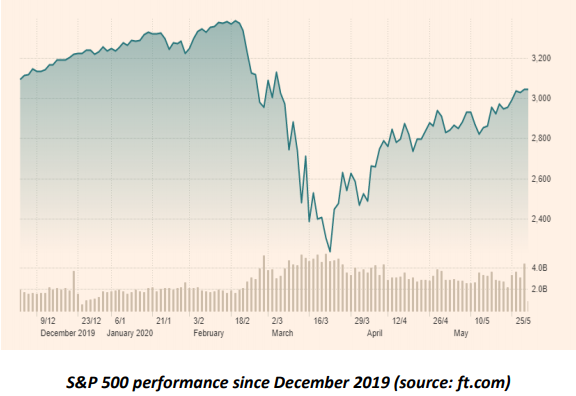

The emergence of the coronavirus at the start of the year and its subsequent spread around the world caused significant alarm, both in terms of the potential human cost and the impact on the global economy from the measures required to contain it. Stock markets reacted by dropping at the sharpest rate on record. To put this into context, at the height of the 2008 financial crisis US shares, as measured by the S&P 500, took over six months to fall by 20% (which in industry terms signifies a shift from a bull to a bear market). The coronavirus only needed a mere three weeks to have the same effect in February.

Warren Buffet is generally recognised as one of the world’s most successful investors, not to mention one of the most often quoted. Buffet’s words of wisdom have earned him the well-deserved nickname of the Oracle of Omaha (after his hometown in Nebraska). In an annual letter to investors in Berkshire Hathaway, the textile factory he took over in 1964 and turned into a multination corporation with interests in insurance, banking, tech and more, Buffet discussed fear and greed. He claimed the impact of these afflictions on the markets were unpredictable, so his approach is ‘to be fearful when others are greedy and to be greedy only when others are fearful’. What he means is if the price of a share seems high, it may not be the right time to invest in it. In contrast, if the price falls, that may present an opportunity. As the saying goes, buy low, sell high.

The theory behind Buffet’s approach is simple. An investor typically buys a share in the hope it will rise in value before selling it for a gain (although some provide a return in the form of a proportion of profits known as dividends). Obviously, the lower the price, the better the chances of earning a higher return when held over the long term (generally five years or more). While Buffet is famous for seeking out shares that appear undervalued by other investors, the same theory applies after a market correction like the one we have just experienced.

Take a look at the chart below of the S&P 500 which represents the share prices of 500 large US companies. After starting to fall in the middle of February, the index hit its lowest point on 23rd March. It has since recovered by over 30%, largely thanks to the unprecedented measures put into action by the US government and the Federal Reserve (the US central bank).

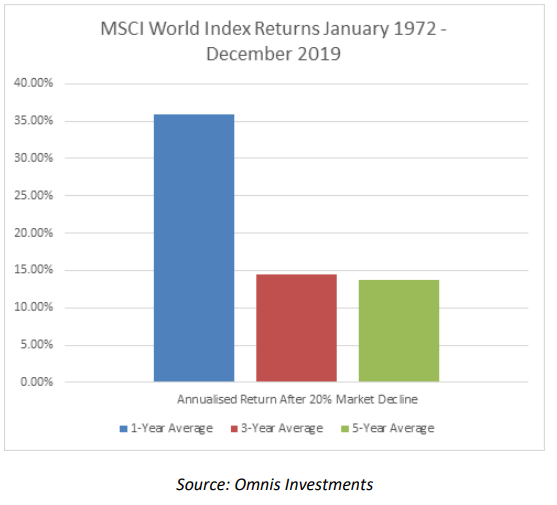

Money invested after a significant fall in the markets tends to deliver a higher average return in the long-term. The rate of growth of a stock market varies from year to year depending on a range of factors that may affect the listed companies directly. Share prices might rise one year and fall the next, but what really matters is performance over the long term. Measuring the average return has the effect of smoothing out these fluctuations. The lower the price when you buy an investment, the more room it has to grow, so the higher the potential average return.

Regardless of when you invest, remember that time in the market, as opposed to timing the market, is one of the most powerful drivers of returns. Turbulence may be hard to stomach, especially when it is as extreme as we witnessed in February and March, but try to avoid any knee jerk reactions which would mean realising losses on your holdings. By staying invested, you should be rewarded over the long term.