Self-employment Income Support Scheme (SEISS)

UPDATED 8 July 2020

If you are eligible for the first grant and have not applied yet, you must do so on or before 13 July.

This scheme is being extended. If you’re eligible for the second and final grant, and your business has been adversely affected on or after 14 July 2020 you’ll be able to make a claim in August 2020.

You can claim for the second grant even if you did not make a claim for the first grant.

To make a claim

To claim you’ll need your:

- Government Gateway user ID and password – if you do not have a user ID, you can create one when you check your eligibility or make your claim

- UK bank details (only provide bank account details where a Bacs payment can be accepted) including:

- bank account number

- sort code

- name on the account

- your address linked to your bank account

- You’ll have to confirm to HMRC that your business has been adversely affected by coronavirus.

Second Scheme Details

The eligibility criteria is the same for the second grant as for the first grant. Individuals will need to confirm that their business has been adversely affected by coronavirus on or after 14 July 2020.

An individual does not need to have claimed the first grant to receive the second grant. For example, they may only have been adversely affected by a coronavirus in this later phase.

What do we know now?

- Applications for the second grant will open in August.

- Individuals will be able to claim a second taxable grant worth 70% of their average monthly trading profits, paid out in a single installment covering three months’ worth of profits, and capped at £6,570 in total.

- The criteria used will be the same as for the first grant and will be based on average profits from tax returns in 2016-17, 2017-18 and 2018-19 to calculate the size of the grant.

- The scheme will be open to those where the majority of their income comes from self-employment and who have profits of less than £50,000. This can be with reference to at least one of the following conditions:

- Your trading profits and total income in 2018/19

- Your average trading profits and total income across up to the three years between 2016-17, 2017-18, and 2018-19.

First Scheme Details

Please note the detailed criteria shown below for the first scheme will apply equally to the second scheme.

On Thursday 26 March, the Chancellor announced a further financial support package for the UK economy to get through the Covid-19 pandemic. This time aimed at the self-employed.

The Chancellor has previously stated how difficult it has been to develop a scheme for the self-employed that is fair and could be delivered efficiently and timely. The Self-employment Income Support Scheme (SEISS) will benefit 95% of people who are majority self-employed.

The headlines of SEISS are:

- It will support self-employed individuals (including members of partnerships) whose income has been negatively impacted by COVID-19.

- The scheme will provide a grant to self-employed individuals or partnerships, worth 80% of their profits up to a cap of £2,500 per month.

- HMRC will use the average profits from tax returns in 2016-17, 2017-18 and 2018-19 to calculate the size of the grant.

- The scheme will be open to those where the majority of their income comes from self-employment and who have profits of less than £50,000. This can be with reference to at least one of the following conditions:

- Your trading profits and total income in 2018/19

- Your average trading profits and total income across up to the three years between 2016-17, 2017-18, and 2018-19.

- The scheme will be open for an initial three months

- The grant will be paid in one lump sum in June for the months of March, April and May. So, the maximum you can get is £7,500.

Further details of the scheme are included below.

Who is eligible?

- You need to be self-employed or a member of a partnership

- You need to have lost trading profits due to coronavirus (Covid-19)

- You need to have filed a tax return for 2018/19

- You need to still be trading now, not just in 2018/19

- You need to take more than half your total income from self-employment

- You need to have trading profits under £50,000. That means a trading profit of less than £50,000 in 2018-19 or an average trading profit of less than £50,000 from 2016-17, 2017-18 and 2018-19.

What if your business has not been going three years?

- The Government will average your trading profits for the longest period possible up to the three tax years – 2016-17, 2017-18 and 2018-19.

- This means if you were only trading for the 2018-19 tax year, they will use these profits only.

What if your business started in the 2019-20 tax year?

- If your business started in the last 11 months and you did not file a tax return for the 2018-19 tax year, you will not be covered by this scheme.

What if you have not submitted your tax return for 2018/19 yet?

- The Government will allow anyone who missed the filing deadline in January, four weeks from today (Thursday 26 March 2020) to submit their tax return.

How will you prove you have made a loss due to coronavirus?

- The Treasury has not set a figure on how much of a loss allows you to claim. In theory you could claim once you’ve lost £1.

- However, tax officials will be able to check you did actually make a reasonable loss when you eventually file your 2020/21 tax return.

- People are being asked to take a “responsible approach”.

- Officials declined to say what the penalties might be if you don’t.

What income is included to assess the 50% rule?

- The eligibility rules state that an individual must take more than half your total income from self-employment.

- Our understanding is that this is based on total taxable income and will include pension income, rental income from buy to let properties, etc.

Is rental income included in the £50,000 a year rule?

- The eligibility rules state that an individual must have trading profits under £50,000.

- Our understanding is that renewal income from buy to let properties is not included in this test as it is not treated as self-employed income.

- However, this also means that SEISS will not apply on this income, even if the property is not let out as a result of coronavirus.

When will the scheme be launched?

- The grant will be paid for all three months in a single lump sum from the beginning of June.

What time period does it cover?

- The scheme will cover the months of March, April and May to start with. It may later be extended.

- It will be paid in a single lump sum which will “start to be paid” at the beginning of June.

How will it work?

- HMRC is designing a “bespoke web portal” through which people apply, a bit like filing your tax return online.

- You will apply through this portal and make several declarations, including that you’ve lost funds as a result of coronavirus.

- You’ll then complete a tax return in due course showing both whether you did actually lose money and showing the taxable grant you received from the government.

- The cash grant from the government will be paid directly into your bank account.

Is the grant taxable?

- Yes, the grant will be taxable and will need to be included in the 2020/21 tax return.

How will I know if I am eligible?

The HMRC portal opened on 13 May enabling individuals to claim under the Self-Employment Income Support Scheme.

Potential claimants can check if they are eligible here.

They will need to input their Self Assessment Unique Taxpayer Reference and National Insurance Number.

If HMRC says they are eligible, they should check their contact details are up to date by logging into their HMRC online account. It should also confirm how much grant they may get and the date they can make their claim from.

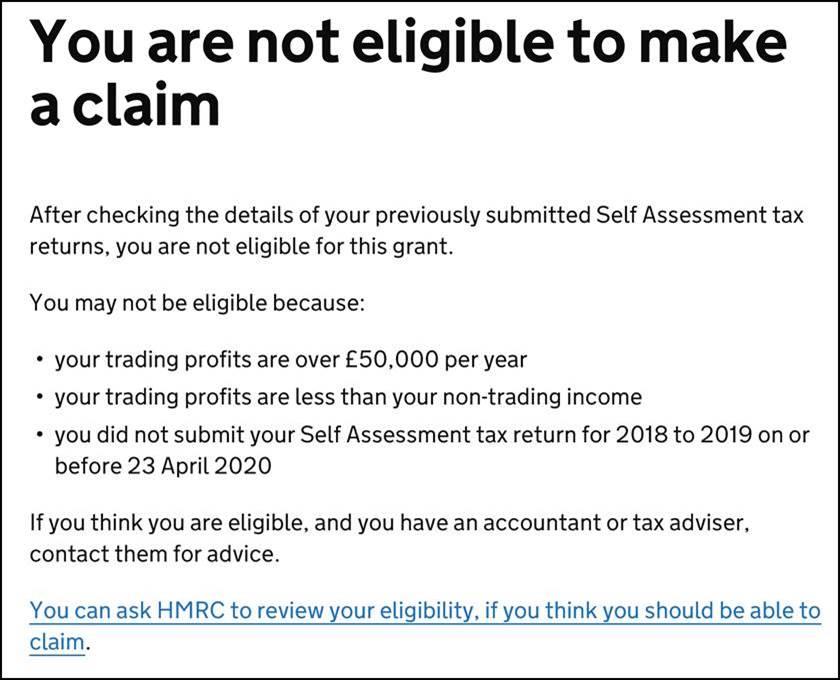

If HMRC says they are not eligible, they will get the following page which does not explain why they are ineligible. But they can ask HMRC to review as you can see (at the bottom).

What if I didn’t make a profit?

- If you didn’t make a profit over the last three years (or the most recent year if you’re new) you can’t claim under this scheme.

What if I pay myself through dividends?

- If you pay yourself through dividends, you’re not eligible for this scheme.

- This is because the tax system cannot distinguish people who pay themselves through dividends from those who claim dividends from shares.

- However, if you paid yourself a salary through PAYE, you can claim a grant worth 80% of wages through the Coronavirus Job Retention Scheme.

What if my profits were lower due to maternity leave or sickness?

- The scheme does not make any allowance for this.

- You will receive your average monthly profits regardless.